Challenge

The COVID-19 pandemic and the dramatic fall in tourism and business travels revealed that IoT roaming contributes to a small, but not insignificant, amount of data consumption across the globe. Since then, mobile operators are on a journey to discover these IoT devices to finally roll out commercial business models to address this market.

A Tier-1 European mobile operator, who already had a few IoT roaming agreements in place, decided to further investigate the amount of permanent roaming devices in silent mode by analyzing the signaling information. The results would determine their future IoT roaming strategy.

Solution

TOMIA’s analysis of the IoT roaming connections and traffic in 2021 showed, that even though international travel was still impacted by the COVID-19 pandemic, retail roaming connections followed a seasonal pattern with a peak in the summer while IoT connections were stable throughout the year. IoT devices represented 70% to 80% of the total number of connections each month, except during summer, when it dropped to 50% of the total connections due of increased human travel.

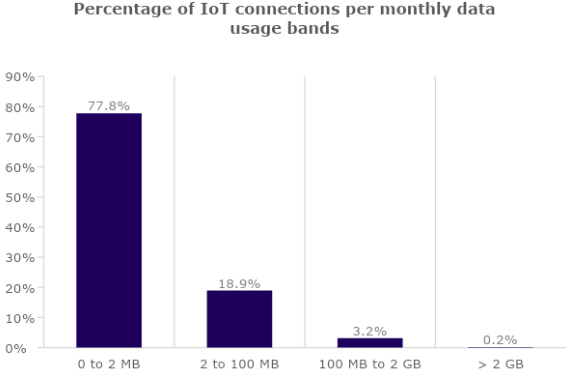

During the entire year, narrowband applications with data consumption of less than 2MB per month represented the majority of IoT roaming connections — 78% of all IoT roaming connections. The number of devices which used between 2 to 100 MB represented 19% of all IoT roaming connections, however, this grew by 42% from January to December, more than the 6% growth in the narrowband connections. This shows a continuous growth in narrowband IoT roaming and a significant increase in devices using between 2 to 100 MB. Broadband IoT will most likely see a significant growth once 5G roaming agreements are rolled out and complement the 4G networks.

Based on the study, the narrowband IoT connections generated an average roaming connectivity revenue per IMSI of 0,01 EUR per month if the wholesale data rates applied to consumers are also applied to IoT. Such a pricing model, based solely on traffic usage, may not only impact the profitability of providing connectivity to a large number of IoT devices but it is not aligned with the value provided by the visited network that connects the IoT roaming devices. This highlights the importance of monetizing the connectivity as a priority, rather than the usage. The journey starts with the detection and segmentation of hidden devices, usually in a state of permanent roaming, and the implementation of a differentiated commercial strategy that is focused on the value of the connectivity for a given IoT application.

Result

Thanks to the availability of both NB-IoT and CAT-M networks, TOMIA has seen a significant increase in these technologies in roaming agreements. Currently, IoT roaming is the main driver for adopting the new GSMA BCE (Billing Charging Evolution), settlement process for which TOMIA has already implemented and tested solutions for European and American mobile operators. TOMIA’s BCE is suitable for IoT as, besides enabling flexible charging models and automated reconciliation resulting in a more efficient cash flow, it is integrated with IoT detection. The solution automates the identification of permanent roaming devices, which can be based on presence (number of roaming days) or usage behavior, and its traffic segmentation into the right commercial agreement.

While 2G and 3G networks are gradually being shut down and 5G networks are being rolled out to equip them with new capabilities, new wholesale charging models for IoT will be needed. These models will be focused on the value of the data rather than on usage. In addition, 5G will require monitoring of the Quality of Service (QoS) to meet the needs of enterprise customers for business critical and premium IoT use cases. It is for this reason and for the accurate measurement of IoT devices and their presence, that TOMIA also uses signaling information in the detection, presence, monetization and QoS solutions for IoT.