Operators worldwide have been making large-scale investments in VoLTE to enable improved and innovative voice and communication services across smartphones and devices. As a result, the rollout of VoLTE networks globally is accelerating. along with an increasing number of VoLTE roaming partnership announcements.

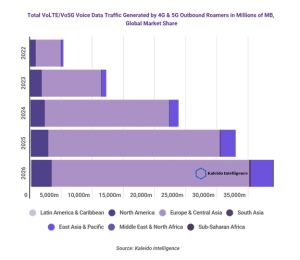

The number of VoLTE service subscriptions is estimated to reach 3.8 billion by the end of 2021; this is forecast to reach 7.2 billion by the end of 2026. Based on the current and future rollouts of VoLTE and VoNG across all country markets, and the average data consumption of HD calls via VoLTE/VoNG, Kaleido estimates that the total data usage generated by these calls will reach nearly 40,000 million MBs of traffic in 2026, up from over 5,000 million MBs of traffic predicted for 2022 (see graph below).

With more operators focusing on 5G rollout and with 4G becoming mainstream, VoLTE roaming has become a key focus area for wholesale managers. This is predominately compounded by a rising number of 2G and 3G network closures globally. A significant number of operators have either shut down or announced closure dates for these networks. As per the latest network closure report compiled by GSMA, there shall be an average of 2 shutdowns per month in the next 3 years, accelerating to 5 shutdowns per month in 2025. The United States, accounting for over 100,000 inbound tourists annually in pre-COVID times, is leading the way as the largest mobile operators plan on closing their 2G/3G networks by 2022. Other countries such as Canada, Malaysia and Japan are following the same route, with some operators being more aggressive than others. Such a decision forces a major shift in the market, as without VoLTE roaming and with the absence of 2G/3G, smartphones will simply not be able to register on the network at all. While the pandemic is not yet over, international travel is expected to normalize by 2023, meaning that operators with a high number of outbound tourists to these countries must act immediately.

With the decommission of 2G/3G networks moving forward rapidly and the appearance of LTE-only operators, home operators who haven’t made the move towards VoLTE roaming yet will have fewer options in visited countries, which may result in steering to non-preferred partners. This certainly puts pressure on their negotiation ability and may increase wholesale costs. Similarly, visited operators who also haven’t progressed with VoLTE roaming may lose inbound roamers to their national competitors. The next few quarters will be critical for VoLTE roaming deployment, and the countdown has begun.

Currently, 1 out of 5 operators that have deployed VoLTE domestically also offer VoLTE roaming. Gradually progressing, the majority (70%) of tier-1 operators according to Kaleido are willing to consider negotiating and reviewing VoLTE roaming agreements with partners during the COVID-19 period of uncertainty. While it is still early days for 5G worldwide, it is quite evident that operators will need to roll out VoLTE networks more urgently as in a 5G SA (standalone) network scenario, only fallback to a VoLTE network is supported.

VoLTE paves the way to the journey to 5G. In other words, VoLTE roaming must act as a predecessor for 5G roaming – all network value added services must support VoLTE to ensure the proper customer experience for consumers and businesses when it comes to 5G use.

Figures and research sourced by Kaleido Intelligence

To continue this discussion and learn more about our solutions, please contact us at: marketing@tomiaglobal.com